The Great Debate: Should You Buy or Lease Your Next Car?

by Robert Solano

For years, Zaira and I wanted a Porsche.

Note: This article was originally written in 2019. Although the cost of vehicles and services has changed, many of the principles remain the same. Also, this article is specific to business vehicles. If you are using a vehicle for personal use, you should always buy or finance it. For personal use, you should NEVER lease… EVER. Leasing a car for personal use is a horrible financial decision in almost all cases.

Here’s the deal—Zaira is finally going to sell her car. It is a RAV 4. Although it has been good, after a small fender bender that resulted in us getting battery acid on us (that’s a story for a different day), it’s time for the Demon Car to go. She has her eyes set on a 2019 Porsche Cayenne as a replacement, but we are not sure if it’s the best decision. There are so many factors to consider like depreciation, tax laws, and more, to figure out what will help us reduce our tax liability and generate the most wealth for our family in the long run.

As a couple, we’ve always tried to make wise financial decisions, and this is no exception. We want to ensure that whatever we decide to do makes the most sense for our business and our family’s future.

We’re considering the option to buy or lease the car. We’re also looking into the possibility of purchasing a used car and utilizing the Section 179 deduction. Our accountant suggested that leasing a car would be the best option, but we want to make sure that we’re making the right choice.

As an engineer, I prefer to do the calculations myself, so I can truly understand the trade-offs. I want to make sure that we’re not leaving any money on the table, and that we’re taking advantage of all the tax benefits available to us. Ultimately, our bookkeeper and CPA will be responsible for filing our taxes, but it’s important for me to understand the ins and outs of this decision.

This decision is not just about buying or leasing a car. It’s about our family’s financial future. We want to make sure that we’re not overspending, and that we’re making the most of our money. We need to take into consideration not just the initial cost of the car, but also the long-term costs associated with it.

In the next part of this article, I will delve into the different options we’re considering, analyzing the tax implications, and the financial impact of each option. While I’m not a financial expert, I hope that this analysis will help others who are in a similar situation make an informed decision.

For some context, my wife Zaira and I are both working professionals who file our taxes jointly. For the purpose of this post, let’s assume that our annual taxable income is $150,000, placing us in the 22% tax bracket. Based on these figures, we anticipate paying a staggering $24,717 in taxes for 2019. Our aim is to legally reduce our tax burden as much as possible.

Recently, Zaira expressed interest in purchasing a 2019 Porsche Cayenne with an MSRP of $65,700. After factoring in the 7% sales tax, the trade-in value of her 2016 Toyota RAV4 at $18,000, and assuming we wouldn’t be putting down a payment, we weighed the pros and cons of leasing versus buying.

If we opt for a 60-month lease with an annual mileage of 10,000, our monthly payments would amount to approximately $277, as calculated by online lease payment calculators. Alternatively, if we choose to finance the car, we would take out a 60-month loan at an interest rate of 4.4%, with monthly payments of $973. Of course, these figures are estimates, and we would seek actual payment information from the Porsche dealer if we were to move forward with this purchase.

To simplify our calculations, we assumed that the value of the Porsche would depreciate to around $30,000 after five years, regardless of whether we leased or financed the car. However, we also considered the option of not purchasing or leasing a car and instead relying on Uber for our transportation needs.

Ultimately, the biggest factor in the analysis we considered was how much wealth we would have generated after a 5-year period. Zaira and I do not want to be “rich,” we want to be WEALTHY! And working together as a couple, and thinking about our finances is one way that helped us become millionaires.

We talk more about how we manage finances as a couple in our book, “Alpha Couples: Build a Powerful Marriage Like a Boss.” I highly recommend our book for entrepreneurial couples, but for now, let’s get back to the analysis.

Option 1: Uber

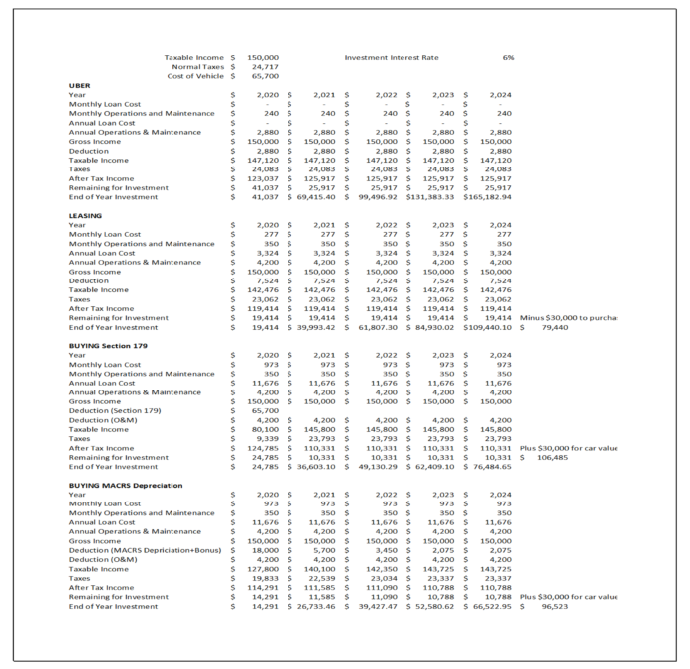

Let’s begin with the cost and financial benefits of using Uber. Zaira’s work mostly involves meeting clients and attending events outside of our home. Based on our estimate, we would spend roughly $240 per month on Uber, with two weeks of use per month, amounting to approximately $120 per week. While the convenience of having a driver allows us to work while commuting, there are also potential drawbacks, such as talkative drivers or scheduling inconveniences. It’s challenging to gauge the impact of using Uber on our productivity and mindset, but I still included that option in our comparison.

According to the IRS, we can claim tax deductions for work-related travel expenses, which means all of Zaira’s Uber rides for work purposes would be eligible for tax deduction. Assuming we spend $240 per month on Uber, that’s a total of $2,880 per year that we can claim as tax deduction. This deduction would bring down our annual taxable income from $150,000 to $147,120 and save us $634 on taxes.

Now, let’s assume that we spend $100,000 each year on food, shelter, and entertainment. After deducting taxes and our Uber expenses, we would have $23,037 left over each year. Additionally, if we sell our current car for $18,000, we can invest that money right away. We can invest the $18,000, along with the remaining $23,037 of our income, into an investment account with a modest 6% annual interest rate. Accounting for inflation and other simplifications, we can expect to have $165,183 in our bank account after 5 years of using Uber instead of buying or leasing a car.

Option 2: Lease

If we opt to lease the Porsche instead of using Uber, then the company would cover the expenses associated with the lease, maintenance, gas, insurance, and other vehicle-related costs. The monthly lease cost is $277, and I estimate an additional $350 per month in operating expenses. This means that our annual lease and operations expenses would amount to $7,524. Our taxable income would then decrease to $142,476, and our remaining income after taxes and expenses would be $119,414. If we invested our remaining income, minus $100,000 for living expenses, we would have $109,440 saved after 5 years. However, after spending $30,000 to purchase the Porsche at the end of the lease, we would only have $79,440 in cash along with the value of the car.

Option 3: Buy

Next, let’s consider the tax savings if I decide to finance the Porsche. The tax code surrounding financing or purchasing a business vehicle can be complex and challenging to understand. It appears that many small business owners opt for leasing as it offers simpler deductions than buying. After spending four hours researching IRS tax codes, I have found two primary methods for deducting vehicle depreciation: the Modified Accelerated Cost Recovery System (MACRS) or IRS Code Section 179 deduction.

MACRS

One method for taxpayers to deduct the depreciation of their vehicle is through the MACRS system. Under this system, taxpayers can deduct the depreciated amount from their income. There is also a special depreciation allowance that allows for deductions of up to $18,000 in the first year. After this, the remaining value of the vehicle would depreciate at a rate of 38% in the second year, 22% in the third year, 13% in the fourth year, and 11% in the fifth year. However, there are limits on the amount that can be deducted in the 2nd, 3rd, 4th, and 5th years, which are $5,700, $3,450, $2,075, and $2,075, respectively. The MACRS system is complex, and there are many stipulations in the code. You can review the information from the IRS here, or consider hiring a CPA for guidance.

Based on my estimates, if I were to use MACRS, my deductions would be limited to $18,000 in the first year, and then $5,700-$2,075 in the following years. Using these deductions, I could expect savings of $66,522 over five years, in addition to the value of the car ($30,000).

Section 179

Alternatively, Section 179 of the IRS Code provides a clause that would allow me to deduct the full cost of the vehicle in the first year, which is $65,700 in my example. The deduction allows businesses to deduct the full cost of the qualifying property from their taxable income in the year the property is purchased and placed into service. This can be a valuable tax benefit for businesses, especially those that earn a lot of income in a year.

However, there are some rules and limitations around using Section 179 for vehicles. First, the vehicle must be used for business purposes at least 50% of the time. This means that if a business owner also uses the vehicle for personal use, they cannot deduct the full cost of the vehicle under Section 179.

Second, the vehicle must meet certain criteria to qualify for the Section 179 deduction. The vehicle must be new (not used) and must be purchased and placed into service in the same tax year. The vehicle must also have a gross vehicle weight rating (GVWR) of 6,000 pounds or more, which includes most SUVs, trucks, and vans used for business purposes.

It’s important to note that Section 179 is complicated, with different rules depending on the weight of the vehicle, and it’s uncertain if the full first-year deduction method will be available in future years. More information about Section 179 is available on this IRS website.

If we were able to deduct the full cost of the vehicle in the first year using Section 179, my taxes in the first year would decrease significantly, by approximately $15,000. The savings in the following years would be less. If I invested the extra cash, I could expect to save up to $76,485 at the end of five years, in addition to the value of the vehicle ($30,000).

My calculation spreadsheet. (I’m an engineer, can you tell).

Section 179 in More Detail: A Valuable Tax Strategy for High-Income Earners

Let’s take a look again at Section 179. In my previous analysis, the Section 179 strategy was comparable to leasing. However, that was driven largely due to our adjusted gross income of $150,000. For higher-income earners, the Section 179 strategy may be a much better option than leasing.

Remember that Section 179 allows businesses to deduct the full cost of qualifying property purchased or leased during the tax year, up to a certain limit. This can be especially beneficial for those who are in a high tax bracket and looking for ways to reduce their taxable income.

The full deduction available under Section 179 applies to qualifying vehicles, which are generally SUVs over 6,000 lbs. The deduction limit for 2022 is $1,050,000, which means that businesses can deduct the full cost of up to $1,050,000 worth of qualifying property purchased or leased during the tax year.

For those in high tax brackets, the ability to deduct the full cost of a vehicle in the year of purchase can result in significant tax savings. For example, if a business owner purchases a $175,000 Mercedes G Wagon AMG (a beautiful car!) and is in the 37% tax bracket, they would be able to deduct the full $175,000 in the year of purchase, resulting in a tax savings of $64,750. This can be especially useful for those who are looking to purchase a higher-end vehicle, such as a luxury SUVs, as the full deduction can offset a significant portion of the cost.

It is important to note that there are certain limitations to Section 179. The deduction is limited to the amount of income the business generates during the tax year, and the total amount of qualifying property purchased or leased during the year. Additionally, the vehicle must be used for business purposes at least 50% of the time to qualify for the deduction.

Another potential limitation is the phase-out threshold. For tax years beginning in 2022, the deduction begins to phase out for businesses that have purchased or leased more than $2,620,000 worth of qualifying property during the tax year. This means that the deduction is reduced by $1 for every $1 over the phase-out threshold, until it is completely phased out. However, most small businesses that I know personally, never approach this threshold.

Despite these limitations, Section 179 can be a valuable tax strategy for high-income earners looking to reduce their tax liability. By deducting the full cost of qualifying property in the year of purchase, businesses can significantly reduce their taxable income and save money on taxes. For those who are considering purchasing a high-end vehicle for their business, Section 179 can make the purchase more affordable and provide significant tax savings in the process.

Summary

In this simplified scenario, the best option is to use Uber. If Zaira and I reduce to a one-car household and use Uber for five years, we could save up to $165,182. Leasing is the next best option. If we were to lease and then buy our Porsche after five years, we could save up to $79,440. The Section 179 full first-year deduction is comparable to leasing. If we were to finance the car for five years and deduct the full cost in the first year, we could expect savings of $76,484, which is only 4% less than the leasing option. The worst option is to use the MACRS depreciation method, which would result in savings of only $66,522 after five years.

If you run a business, choosing whether to buy or lease a vehicle is an important decision that can have a significant impact on your bottom line. Generally speaking, leasing is the better option from a net cost perspective, as it offers simpler deductions and lower upfront costs. However, if you need a larger vehicle, such as an SUV weighing over 6000 pounds, then Section 179 tax rules make buying a comparable option. This is because the Section 179 deduction allows you to write off the full purchase price of the vehicle, up to a certain limit, in the first year, reducing your taxable income and providing significant tax savings. The break-even point, where it becomes more beneficial to purchase rather than lease, varies depending on your income and vehicle purchase price, but it’s typically around $150,000 to $200,000 in annual income. This is especially true for higher-income earners/business owners and more expensive luxury SUVs. For lower-income earners and smaller cars, leasing is usually a better option due to its simpler deductions which are spread out over years. However, it’s important to remember that these considerations are for business vehicles only and don’t apply to personal cars. As another reminder, consult with a tax professional (not me) before making important tax and financial decisions.

Update

In 2019, we ended up purchasing a Mercedes GLE 450 and love it! I’ll let you guess which tax accounting strategy we used.

In 2022, we also bought a Porsche Taycan which we rent out on Turo.Even though it weighs more than 6,000 lbs, our tax accountant advised us that it did not qualify as a Section 179 dedication since it is a sports car and not an SUV.

In 2022, we finally got the Porsche!